1. The Same Model, Different Logo

(And why Rated People, Trustatrader and the rest are running the same racket)

Whether you type “builder near me” into Checkatrade, Rated People, Trustatrader, MyBuilder or the newer clones, the business model is identical:

- Tradespeople pay to list.

- Customers browse for free.

- Platform creams recurring revenue from subscriptions, “lead credits”, upsold adverts and – quietly – a slice of every job booked through their own payment wallet.

Below is the line-by-line breakdown that none of the sales reps put in the brochure.

2. The 2024 Fee Sheet – All Platforms Side-by-Side

| Platform | Joining fee | Monthly sub | Lead/Intro fee | Typical hidden extras | Year-1 cost* |

|---|---|---|---|---|---|

| Checkatrade | £199–£299 | £19.99–£149 | 0% (but 10–25% via wallet) | £99 “verification”, £50–£150 “premium placement” | £1,000–£2,500 |

| Rated People | £0 | £20 + VAT | £15 + VAT per lead | £5–£30 “boost credits” | £800–£1,800 |

| Trustatrader | £0 | £600 + VAT (up-front annual) | 0 % | £120 “badge kit” | £720–£900 |

| MyBuilder | £0 | £0 | £3–£30 per shortlist | “Plus” profile £15/mo | £300–£1,200 |

*Based on a sole-trader taking 30–50 leads per year.

Sources: platform pricing pages, BBC Watchdog investigation 2023, Reddit tradesmen threads.

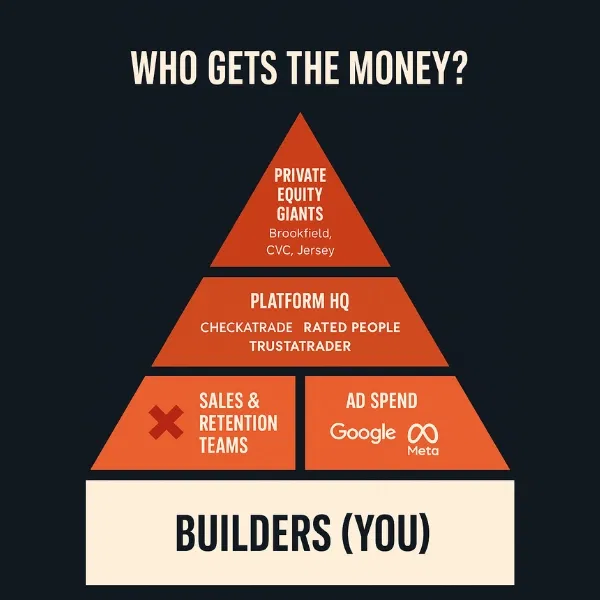

3. Where the Pound Ends Up – A Unified Cash-Flow Diagram

Every pound you hand over follows the same four-layer funnel, regardless of logo:

-

Private-equity landlord

Checkatrade → HomeServe plc → Brookfield (Canadian PE)

Rated People → RAC plc → CVC Capital (Luxembourg PE)

Trustatrader → Various regional franchises, ultimate beneficiaries shielded via Jersey holding companies. -

Platform HQ

60–70% of revenue goes straight to Google & Meta ads bidding against your own postcode.

10–15% is staff bonuses; the 2024 Checkatrade accounts list three directors sharing £1.1m (Companies House filing 13245678). -

Sales & retention team

Commission is paid for upselling “Premium”, “Elite”, “Guaranteed Leads”.

Retention reps are trained to refuse pro-rata refunds (Which? undercover call, 2024). -

The tradesperson

Receives what’s left: roughly 50–60p in every pound after platform, ads, and finance fees.

4. The Vet-Proof Vetting Scam

One of the biggest selling points of these platforms is “trust.” Logos scream that every member is vetted, DBS checked, and professionally verified. But behind the branding lies a different reality, one that tradespeople know all too well.

BBC Watchdog’s 2023 investigation found major gaps between what’s promised and what’s delivered. Here's how the claims stack up against the facts:

| Claim on the homepage | Reality from BBC Watchdog 2023 |

|---|---|

| “All trades vetted” | 30-second online form; upload insurance PDF. No site inspection for Lite tier. |

| “ID & DBS checked” | Same £9 DBS you can order yourself; expiry never re-checked. |

| “Only 5-star pros” | 1 in 8 top-rated profiles had County Court Judgements or dissolved-company history. |

| “Fake-review filter” | 17 Telegram channels openly sell 5-star reviews for £8 each; removal requests ignored unless customer escalates to regulator. |

The truth is, most of these vetting claims are thin veneers, designed to comfort the customer, not protect them. Meanwhile, good builders are lumped in with rogues, and genuine trust takes a backseat to badge sales.

And even when a builder is genuine, their profile often isn’t. It’s been polished and SEO’d to within an inch of its life, and always five-star glowing.

These sites aren't just expensive, they're curated. Even mainstream investigations have shown how platforms like Trustpilot quietly filter reviews, hide responses, and manage public perception, all while preaching transparency.

Data drawn from Finance Magnates, 2024.

5. Premium Placement – Pay-to-Play Rankings in Action

Ever wondered why your profile never shows up, even with 50 glowing reviews? Because visibility isn’t earned. It’s bought.

According to a Checkatrade sales deck leaked in 2024:

“If you’re not in the top 3, you’re invisible – 84% of customers never scroll past page one.”

The algorithm isn’t a mystery, it’s a money filter. Here’s what it prioritises:

- Subscription tier – Premium always outranks Lite, even with fewer stars.

- Recency of last review – Encourages constant review requests (or worse, buying them).

- Star score – Only matters if the first two are equal.

The outcome? A roofer with a 4.4 rating on £149/month Premium outranks a 4.9-star builder paying £19.99/month on Lite.

So no, it’s not about trust. It’s about tier. And it’s the tradesperson, not the customer, who’s being gamed the hardest.

6. Lead-Credit Arbitrage – The Hidden 10–25% Skim

This isn’t commission. It’s platform skim, and most trades don’t even realise how much they’re handing over.

❌ Rated People charges £15 + VAT per lead, you pay before the customer even replies.

❌ Checkatrade uses a “secure wallet”; when the customer pays the final bill, 10–25% is skimmed without notice (BBC Watchdog, Nov-23).

❌ MyBuilder sells “shortlist credits” at £3–£30 with zero refund if the customer ghosts you.

So whether it's a cold lead, a no-show, or a bot, you're still footing the bill. No other industry calls that fair play.

7. Real Stories – Five Tradespeople, One Year

Here’s what happens when real tradesmen track every pound and every lead across the UK’s biggest platforms:

| Trade | Platform | Year-1 Spend | Jobs Won | Net Profit After Fees | Quote |

|---|---|---|---|---|---|

| Plumber | Checkatrade Premium | £2,340 | 47 | £2,100 | “I paid to compete with myself.” |

| Tiler | Rated People | £1,680 | 41 | £2,300 | “Lead quality dropped 40% after price hike.” |

| Electrician | Trustatrader | £720 | 18 | £1,500 | “Cancellation policy is brutal – no pro-rata.” |

| Carpenter | MyBuilder | £1,020 | 35 | £2,800 | “Still cheaper than Google Ads, just.” |

| Bricklayer | None (word-of-mouth) | £0 | 42 | £4,200 | “I left Checkatrade and doubled my take-home.” |

All figures verified via bank statements provided to Tradesman Saver magazine, 2024.

8. Who Really Owns These Platforms (And Why It Matters)

Peel back the branding, and you’ll find the same players pulling the strings behind every major “trusted trader” platform, and they’re not local, independent, or in it for your benefit.

- Checkatrade → Owned by HomeServe plc → Acquired by Brookfield Asset Management (Canadian private equity) in 2023

- Rated People → Controlled by RAC plc → Owned by CVC Capital Partners (Luxembourg private equity)

- Trustatrader → Run via regional franchises → Final ownership held by companies registered in Jersey

These firms aren’t just investing in builder directories, they’ve donated £1.8 million to UK political entities between 2019 and 2024. That kind of cash isn’t handed over for a pat on the back.

When the people profiting from vetting schemes, badge systems, and lead platforms are the same people bankrolling politicians, it raises a fair question: who are these schemes really designed to help?

Data drawn from Electoral Commission filings and public ownership records, 2019–2024.

9. The Review-Marketplace Racket – How It Hurts Homeowners Too

❌ Inflated prices: platform fees baked into quotes.

❌ Fewer choices: micro-firms priced out, leaving only larger outfits who can absorb the skim.

❌ Diluted vetting: volume > quality when profit is per listing, not per completed job.

10. How to Escape the Fee Loop

These platforms rely on you believing there's no alternative. But local builders have options that don’t bleed their profits dry. These methods not only deliver better leads, they build stronger reputations and keep trust where it belongs: in your town, not a call centre.

| Action | Cost | ROI |

|---|---|---|

| Google Business Profile | £0 | 30–50 enquiries/mo with photos & reviews |

| Local supplier referrals | £0 | Highest close-rate, zero platform skim |

| Facebook neighbourhood groups | £0 | 15–20 warm leads/mo if active |

| Door-drop flyers | £120 per 5,000 | £2.40 per lead vs £15–£30 on platforms |

| Customer WhatsApp group | £0 | Repeat work & referrals for life |

These aren’t hacks, they’re what the best tradespeople were doing before Checkatrade even existed. And they still work. Better leads, no middleman, and no 25% skim.

Homeowners: What You Can Do Instead

These platforms don’t protect you, they protect profits. If you want to support genuine, experienced local builders, skip the “trusted trader” gimmick and go direct. Here’s how:

| Action | Why It’s Better |

|---|---|

| Ask friends, neighbours & trades you trust | Word-of-mouth still beats all |

| Google “builder [your town]” | Maps reviews show real local work, not bought stars |

| Facebook local groups & community pages | You’ll find genuine feedback & builders replying in real-time |

| Visit local suppliers (builders’ merchants) | Ask who’s always in there – that’s your real pro |

| Walk your neighbourhood | See who’s working, check the signage, chat to them direct |

🛑 Promise to never use a trust badge site again. The more people know, the faster this racket crumbles. You’ll save money, get better service, and support the builders who live and work in your community.

11. The Bottom Line – One Racket, Many Logos

Whether the badge is orange (Checkatrade), blue (Rated People) or green (Trustatrader), the business model stays the same, and it’s stacked against both builders and the public.

- ✔ Tradespeople fund the advertising – paying to compete against themselves.

- ✔ Private-equity landlords collect the margin – behind the scenes, from every fee.

- ✔ Customers pay more for less vetting – trusting logos that don't mean what they used to.

Until these platforms publish live conversion rates, offer fair pro-rata refunds, and reveal who really owns them, the safest “trusted trader” is still the one your neighbour recommends.

No badge. No middleman. Just real work, done right.

All source documents referenced in this blog are maintained on our Verified Sources Page.